Investing in the stock market requires reliable data and powerful tools. MarketXLS offers an Excel-based solution designed for investors.

But, there are other options available too. Exploring the competitors of MarketXLS can help you find the best fit for your needs. Each tool comes with unique features and benefits. By comparing these options, you can make an informed decision.

This article will delve into various MarketXLS alternatives, helping you understand their strengths and weaknesses. Whether you are a professional investor or a beginner, knowing your options ensures you choose the right tool for effective stock market analysis. Let’s dive in and explore the top MarketXLS competitors.

Credit: marketxls.com

Introduction To Marketxls And Its Purpose

MarketXLS is an Excel-based software designed for stock market research and investment management. It provides real-time data and advanced tools to help users make informed decisions. The software is ideal for investment professionals and individual investors.

What Is Marketxls?

MarketXLS is a comprehensive Excel solution tailored for stock traders and investors. It integrates real-time data and advanced analytics directly into Excel. This enables users to access up-to-date information and perform detailed analysis.

| Feature | Description |

|---|---|

| Real-time Data Updates | Provides live data to models, insights, and portfolio statuses. |

| Enterprise-grade Service | Suitable for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors. |

| Premium Support | Includes AI and automatic spreadsheet builder, access to billions of data points, and multi-channel support. |

| Instrument Coverage | Covers over 13,574 stocks, 3,119 ETFs, 26,802 mutual funds, millions of options, 9,600 crypto symbols, 300+ economic datasets, and 75+ forex pairs. |

| Streaming Quotes | Offers live stock data or refresh on demand. |

| Options Data | Provides real-time stock options prices, options filtering, and scanning. |

| Portfolio Management | Tools to track, manage, and optimize portfolios. |

| Historical Data | Access to historical stocks and options data. |

| Technical Analysis | Over 100 technical indicators like Bollinger bands, Moving averages, stochastics, MACD. |

| Google Sheets Integration | Plugin available for non-Windows users to get live prices and data. |

| Templates and Models | Pre-made stock lists, symbol lookup, industry and sector classifications, Twitter integration, valuation models. |

| Charts | Beautiful, integrated charts within Excel. |

| Crypto Data | Data from 17 exchanges and 1,200 crypto symbols. |

| Stock Screening | Screen stocks by hundreds of custom parameters. |

| Global Coverage | Add-ons available for Futures, European Stocks, and International markets. |

Why Financial Analysts Use Marketxls

- Enhanced investment research: Real-time data and comprehensive market coverage.

- Streamlined workflows: Tools to optimize investment strategies.

- Advanced analytics: Over 100 technical indicators and historical data.

- High-quality support: Premium support via phone, chat, or email.

- Integration: Compatible with Excel and Google Sheets for data-driven analysis.

Key Features Of Marketxls

MarketXLS is an Excel-based software that simplifies stock market research, tracking, and investing. It offers a wide range of features designed to aid investment professionals and individual investors in making informed decisions. Let’s dive into the key features of MarketXLS.

Data Integration And Analysis

MarketXLS allows seamless data integration and analysis within Excel. Users can access billions of data points and perform advanced security analysis. It supports comprehensive market coverage, including 13,574+ stocks, 3,119+ ETFs, 26,802 mutual funds, and millions of options. This extensive data integration helps in making better research, faster decisions, and more profits.

Real-time Stock Data

One of the standout features of MarketXLS is its ability to provide real-time stock data. Users can stream live stock data or refresh on demand. The software also offers real-time stock options prices, options filtering, and scanning. This ensures that investors have up-to-date information at their fingertips, crucial for making timely investment decisions.

Customizable Templates

MarketXLS comes with a variety of customizable templates and models. These include pre-made stock lists, symbol lookup, industry and sector classifications, and valuation models. Additionally, it integrates beautiful charts within Excel, enhancing the visual representation of data. Users can also access templates for portfolio management, making it easier to track, manage, and optimize their investments.

Competitor 1: Bloomberg Terminal

Bloomberg Terminal is a renowned market research tool in the financial sector. Known for its advanced features and extensive data coverage, it is often compared to MarketXLS.

Overview Of Bloomberg Terminal

Bloomberg Terminal provides real-time financial data, news, and analytics. It is widely used by finance professionals for trading, investment analysis, and risk management.

Key Features And Benefits

- Real-Time Data: Offers real-time market data, news, and financial analytics.

- News and Research: Provides comprehensive news coverage and research reports.

- Advanced Analytics: Includes tools for technical analysis, portfolio management, and risk assessment.

- Wide Coverage: Covers a broad range of asset classes, including stocks, bonds, commodities, and forex.

- Networking: Allows users to connect with other finance professionals through its messaging and collaboration tools.

- Integration: Integrates seamlessly with other financial software and tools.

Pricing And Affordability

Bloomberg Terminal’s pricing is premium, reflecting its comprehensive features and extensive data coverage. The subscription cost can be prohibitive for individual investors or small firms.

| Subscription Type | Cost |

|---|---|

| Annual Subscription | Approximately $20,000 – $25,000 |

While Bloomberg Terminal offers robust features, the high cost may be a barrier for many users. MarketXLS, on the other hand, provides a more affordable solution with extensive market data and tools within Excel.

Competitor 2: Morningstar Direct

Morningstar Direct is a robust investment analysis platform that competes with MarketXLS. It is designed to offer comprehensive data, research tools, and analytics for financial professionals and individual investors. Below, we explore its key features, benefits, and pricing.

Overview Of Morningstar Direct

Morningstar Direct provides a suite of investment analysis tools, robust data, and research capabilities. It is widely used by asset managers, financial advisors, and institutional investors. The platform aims to help users make informed investment decisions by offering deep insights into market trends and asset performance.

Key Features And Benefits

- Comprehensive Data Coverage: Access to a wide range of asset classes, including stocks, bonds, mutual funds, and ETFs.

- Advanced Analytics: Tools for portfolio analysis, risk assessment, and performance attribution.

- Research Tools: In-depth research reports and data visualization tools to help understand market movements.

- Custom Reporting: Ability to create customized reports and dashboards to track investment performance.

- Integration: Seamless integration with other financial software and data providers.

Pricing And Affordability

Morningstar Direct offers tiered pricing based on the needs of the user. It provides solutions for individual investors, small advisory firms, and large institutional clients. Pricing is customized and can vary widely based on the features and data required. Potential users are encouraged to contact Morningstar directly for a quote tailored to their specific needs.

| Plan | Features | Price |

|---|---|---|

| Individual | Basic features, limited data access | Custom pricing |

| Small Firm | Advanced features, moderate data access | Custom pricing |

| Institutional | Full features, extensive data access | Custom pricing |

Competitor 3: Factset

FactSet is a well-known competitor of MarketXLS, offering financial data and analytics solutions. It caters to investment professionals, providing a comprehensive suite of tools to manage and analyze financial information.

Overview Of Factset

FactSet is a financial data and software company that provides integrated data and software solutions for investment professionals. Established in 1978, it has grown to serve thousands of clients worldwide.

The company combines comprehensive financial information, analytics, and workflow solutions into a single platform. This allows users to make informed investment decisions and streamline their processes.

Key Features And Benefits

| Feature | Benefit |

|---|---|

| Real-time Data | Provides up-to-date financial information for accurate decision-making. |

| Global Market Coverage | Access to data from markets around the world, enhancing investment opportunities. |

| Advanced Analytics | Offers powerful analytics tools to help users analyze financial data effectively. |

| Customizable Dashboards | Allows users to create personalized dashboards for better data visualization. |

| Integration Capabilities | Seamlessly integrates with other financial tools and platforms. |

Pricing And Affordability

FactSet’s pricing is tailored to the needs of each client, with costs based on the range of services and data required. This ensures that clients only pay for what they use.

While FactSet may be more expensive than some competitors, the extensive range of features and high-quality data justify the cost. Prospective clients can request a demo or consultation to better understand the pricing structure and how it fits their needs.

Competitor 4: Ycharts

YCharts is a powerful web-based platform that provides financial data and analysis tools. It is designed for finance professionals, helping them make informed investment decisions. While MarketXLS integrates directly with Excel, YCharts offers a different approach, making it a strong competitor.

Overview Of Ycharts

YCharts is known for its in-depth financial data and user-friendly interface. It serves financial advisors, asset managers, and individual investors. The platform offers advanced tools for fundamental analysis, portfolio management, and market research.

Key Features And Benefits

- Comprehensive Data: YCharts provides a vast amount of financial data, including stock prices, economic indicators, and market indices.

- Customizable Charts: Users can create detailed and interactive charts to visualize data trends and patterns.

- Screeners and Alerts: The platform offers advanced screening tools to filter stocks based on specific criteria and set alerts for key events.

- Portfolio Management: YCharts includes tools for portfolio analysis, helping users monitor performance and risk.

- Integration: It integrates with various financial platforms and software, enhancing its usability.

Pricing And Affordability

YCharts offers several pricing plans to cater to different user needs. The pricing structure is tiered based on the features and data access provided:

| Plan | Features | Price |

|---|---|---|

| Basic | Access to essential financial data and basic charting tools. | $200 per month |

| Professional | Advanced data access, customizable charts, and screeners. | $400 per month |

| Enterprise | Full data access, premium support, and custom integrations. | Custom pricing |

YCharts also offers a free trial for users to explore its features before committing to a subscription. This allows potential users to assess the platform’s value and determine if it meets their investment needs.

Competitor 5: Capital Iq

Capital IQ is a strong competitor to MarketXLS. It offers a wide range of features and services aimed at investment professionals. This section will provide an overview of Capital IQ, its key features and benefits, and its pricing and affordability.

Overview Of Capital Iq

Capital IQ is a product of S&P Global. It provides comprehensive data and analytics for financial professionals. With its robust platform, users can access detailed financial information, research, and analysis. Capital IQ is known for its extensive database, which covers companies, markets, and industries worldwide.

Key Features And Benefits

- Extensive Database: Capital IQ offers a vast amount of financial data, including company profiles, financial statements, and market data.

- Advanced Analytics: Users can perform complex financial modeling and analysis using powerful tools and features.

- Research and Reports: Access in-depth research reports from S&P Global and other leading providers.

- Real-time Data: Receive real-time financial news and updates, helping users stay informed on market developments.

- Customizable Dashboards: Create personalized dashboards to track key metrics and data points relevant to your investment strategy.

Pricing And Affordability

| Plan | Features | Pricing |

|---|---|---|

| Basic | Access to fundamental data, limited analytics | Contact for pricing |

| Professional | Enhanced analytics, real-time data, research reports | Contact for pricing |

| Enterprise | Full access, custom solutions, dedicated support | Contact for pricing |

Capital IQ’s pricing is available upon request. Customized solutions and enterprise-level features come with tailored pricing options.

Pros And Cons Of Marketxls And Its Competitors

MarketXLS is a leading Excel-based tool for stock market research, tracking, and investing. It offers real-time data, advanced analytics, and robust portfolio management features. However, like any product, it has its advantages and disadvantages, especially when compared to its competitors. Let’s dive into the pros and cons of MarketXLS and its main competitors.

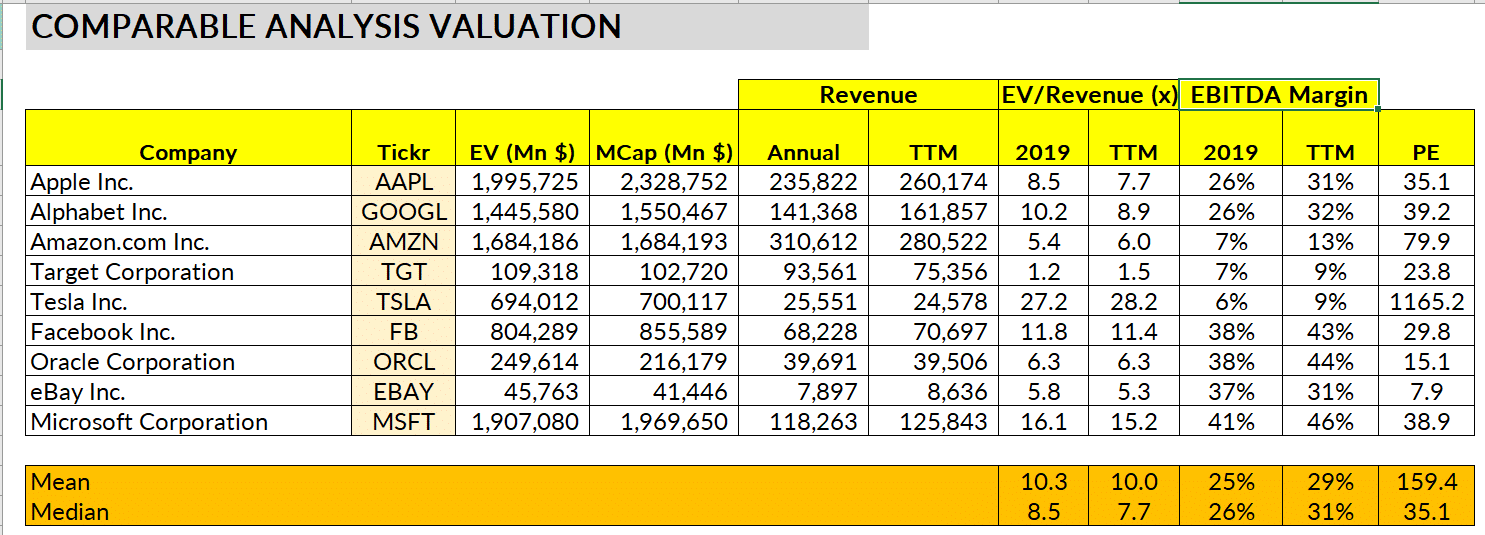

Comparative Analysis Of Marketxls

MarketXLS stands out for its comprehensive real-time data updates and enterprise-grade service. It supports a wide range of financial instruments, including stocks, ETFs, mutual funds, options, cryptos, and forex pairs. The integration with Excel allows for advanced technical analysis and the use of over 100 technical indicators.

However, competitors also offer unique strengths. Here is a table comparing MarketXLS with some of its main competitors:

| Feature | MarketXLS | Competitor A | Competitor B |

|---|---|---|---|

| Real-time Data | Yes | Yes | No |

| Portfolio Management | Yes | Yes | Yes |

| Technical Indicators | 100+ | 50+ | 70+ |

| Google Sheets Integration | Yes | No | Yes |

| Customer Support | Premium | Standard | Premium |

Strengths And Weaknesses Of Each Competitor

Competitor A

Strengths:

- Real-time data updates

- Comprehensive portfolio management tools

- Good customer support

Weaknesses:

- Fewer technical indicators compared to MarketXLS

- No Google Sheets integration

Competitor B

Strengths:

- Supports a wide range of technical indicators

- Integration with Google Sheets

- Premium customer support

Weaknesses:

- No real-time data updates

- Limited portfolio management features

In summary, while MarketXLS offers extensive features and robust support, each competitor brings unique advantages. Evaluating these strengths and weaknesses can help you choose the best tool for your investment needs.

Recommendations For Ideal Users

MarketXLS is a powerful Excel-based tool designed for both professionals and individual investors. Its real-time data updates and extensive market coverage make it a versatile option. But who exactly should use MarketXLS, and which competitors cater to specific needs? Let’s explore.

Who Should Use Marketxls?

MarketXLS is ideal for those who need real-time data, advanced security, and optimized data streaming in Excel. Here are some of the key users:

- Investment Managers: Access to real-time data and enterprise-grade service.

- RIAs (Registered Investment Advisors): Comprehensive tools for portfolio management.

- Asset Managers: Tools to track, manage, and optimize portfolios.

- Financial Analysts: Over 100 technical indicators for thorough analysis.

- Individual Investors: Historical data and real-time updates for informed decisions.

Which Competitor Is Best For Specific Needs?

| Competitor | Best For | Key Features |

|---|---|---|

| Yahoo Finance | Basic stock data and news | Free access, news updates, simple stock screeners |

| TradingView | Technical analysis and charting | Advanced charting tools, social community, scriptable indicators |

| Morningstar | Research and investment analysis | In-depth research reports, fund analysis, investment ratings |

| Bloomberg Terminal | Professional financial analysis | Comprehensive data, powerful analytical tools, extensive market coverage |

| Google Finance | Casual investors and quick checks | Free access, basic stock information, easy-to-use interface |

Each competitor offers unique features tailored to specific needs. For example, Yahoo Finance is suitable for those needing basic stock data and news. In contrast, TradingView is best for users who require advanced charting tools and technical analysis.

If you need in-depth research and investment analysis, Morningstar is a strong competitor. For professional-level financial analysis, Bloomberg Terminal provides comprehensive data and powerful tools. Finally, Google Finance is great for casual investors looking for quick checks and basic stock information.

Credit: www.g2.com

Credit: www.g2.com

Frequently Asked Questions

What Are The Top Alternatives To Marketxls?

Some top alternatives are Excel Price Feed, Quandl, Alpha Vantage, TradingView, and Yahoo Finance.

How Does Excel Price Feed Compare To Marketxls?

Excel Price Feed offers real-time financial data directly in Excel. It’s a strong competitor to Marketxls.

Is Alpha Vantage A Good Marketxls Competitor?

Yes, Alpha Vantage provides free API access for stock market data, making it a popular choice.

Can Tradingview Replace Marketxls For Financial Analysis?

TradingView offers advanced charting tools and social trading features. It’s a good alternative for financial analysis.

What Makes Yahoo Finance A Marketxls Competitor?

Yahoo Finance provides comprehensive financial news, data, and analysis tools. It’s a reliable alternative to Marketxls.

Conclusion

Choosing the right tool for stock trading is essential. MarketXLS offers comprehensive features and robust data support. It stands out with real-time updates, portfolio management, and technical analysis tools. Whether you are a professional or individual investor, MarketXLS can enhance your investment strategy. For a detailed look and to explore its features, visit MarketXLS Excel Solution. Compare it with its competitors and make an informed decision. Happy investing!