Wave Accounting and QuickBooks are popular accounting tools. Both offer free and paid options.

Choosing the right accounting software can be challenging. Wave Accounting and QuickBooks stand out as top contenders. Each has unique features and pricing plans. This comparison helps you understand what each offers. You will learn about the pros and cons of free and paid versions.

This insight helps you make an informed decision. Let’s explore Wave Accounting and QuickBooks in detail. This will guide you to the best choice for your business needs. Get ready for an in-depth look at these two accounting solutions.

Credit: zapier.com

Wave Accounting Overview

Wave Accounting is a popular choice for small business owners. It offers a range of features designed to simplify financial management. This free accounting software provides tools to help you stay on top of your finances. Let’s explore what Wave Accounting has to offer.

Features

Wave Accounting includes invoicing, receipt scanning, and expense tracking. You can create and send professional invoices in minutes. The software also allows you to scan receipts using your smartphone. This feature helps you keep track of all your expenses. Additionally, Wave provides double-entry accounting. This ensures your financial records are accurate and complete.

User Experience

Wave Accounting boasts an intuitive interface. Users find it easy to navigate the dashboard. The design is clean and user-friendly. Even beginners can manage their finances with ease. Wave also offers a mobile app. This allows you to access your financial data on the go. The app is available for both iOS and Android devices. Customer support is available through email and live chat. This ensures you get help when you need it.

Quickbooks Overview

QuickBooks is a popular accounting software designed to cater to various business needs. It offers both free and paid options, each with unique features to help manage finances efficiently. Understanding these features and user experience can help decide the best option for your business.

Features

QuickBooks provides a wide range of features to assist with financial management. Here are some key features:

- Invoicing: Create and send customized invoices to clients.

- Expense Tracking: Track and categorize expenses with ease.

- Bank Reconciliation: Reconcile bank transactions automatically.

- Payroll Management: Manage payroll for employees efficiently.

- Reporting: Generate detailed financial reports for insights.

- Tax Preparation: Prepare and file taxes with built-in tools.

User Experience

QuickBooks aims to provide a user-friendly experience for all users. Here are some aspects of the user experience:

- Intuitive Interface: The software has a clean and simple interface.

- Mobile App: Access QuickBooks on the go with the mobile app.

- Customer Support: Get help from customer support via chat or phone.

- Customization: Customize features to fit specific business needs.

QuickBooks is designed to simplify accounting tasks and improve financial management. Its features and user-friendly interface make it a strong contender for businesses of all sizes.

Free Vs Paid Options

Choosing the right accounting software can be tricky. Comparing free and paid options helps you make an informed decision. Let’s explore the free and paid plans of Wave Accounting and QuickBooks.

Wave Free Plan

Wave offers a completely free accounting plan. It includes invoicing, receipt scanning, and accounting features. Users benefit from unlimited income and expense tracking. The software is user-friendly and ideal for small businesses.

- No cost for basic features

- Unlimited bank and credit card connections

- Free customer support via email

Quickbooks Free Plan

QuickBooks does not offer a free plan. Users can access a 30-day free trial instead. This trial provides full access to all features. After 30 days, users must switch to a paid plan.

Key features of the QuickBooks free trial:

- Full-feature access for 30 days

- Includes invoicing, expense tracking, and reports

- No credit card required for the trial

Paid Plans Comparison

Wave and QuickBooks offer various paid plans. Here’s a comparison to help you decide:

| Feature | Wave Paid Plans | QuickBooks Paid Plans |

|---|---|---|

| Monthly Cost | None | Starts at $25/month |

| Payroll | Starts at $20/month | Starts at $45/month |

| Advanced Reporting | Not available | Included in higher plans |

| Customer Support | Email support only | 24/7 support (higher plans) |

QuickBooks offers more advanced features and support in their paid plans. Wave remains a great free option for small businesses.

Cost Analysis

Understanding the cost differences between Wave Accounting and QuickBooks is crucial for making the right choice for your business. This section will break down the monthly and annual costs for both, along with any hidden fees you might encounter.

Monthly Costs

Both Wave Accounting and QuickBooks offer different pricing tiers. Here’s a breakdown:

| Service | Free Option | Paid Option |

|---|---|---|

| Wave Accounting | Free | Not Applicable |

| QuickBooks | Not Available | $25 to $180 per month |

Wave Accounting offers a comprehensive free plan, while QuickBooks has several paid plans with varying features.

Annual Costs

Calculating annual costs can help you budget effectively. Let’s look at the yearly expenses:

| Service | Free Option | Paid Option |

|---|---|---|

| Wave Accounting | Free | Not Applicable |

| QuickBooks | Not Available | $300 to $2,160 per year |

Wave remains free throughout the year, while QuickBooks’ annual costs depend on the selected plan.

Hidden Fees

Hidden fees can be a burden. Both platforms have some additional costs to consider:

- Wave Accounting: Charges for payroll and payment processing.

- QuickBooks: Charges for payroll, additional users, and third-party integrations.

Be aware of these potential hidden fees to avoid unexpected expenses.

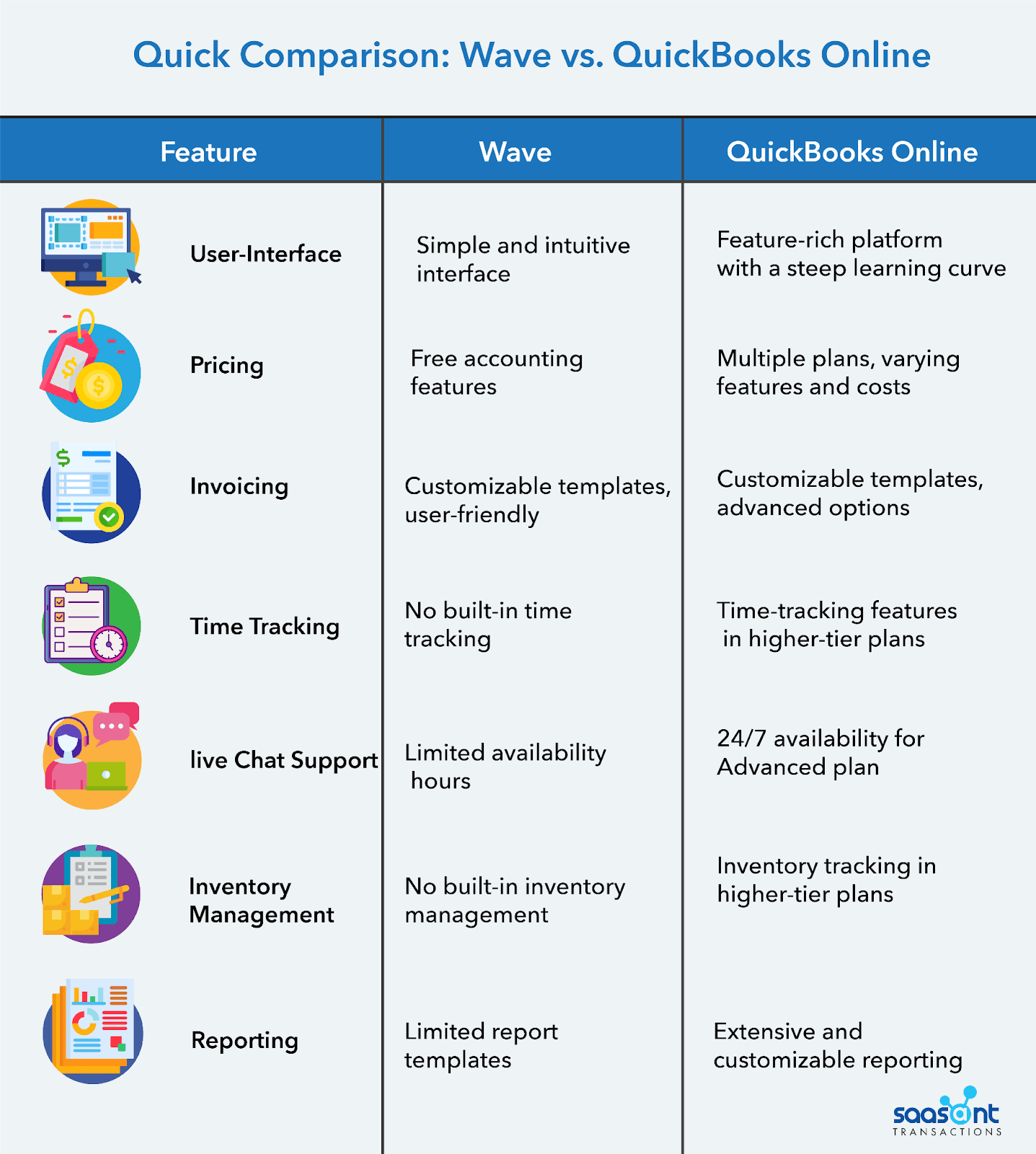

Ease Of Use

Wave Accounting offers a user-friendly experience, perfect for small businesses. Quickbooks, both free and paid, provides more advanced features but can be more complex.

Choosing accounting software can be difficult. Ease of use is a key factor. Wave Accounting and QuickBooks offer both free and paid options. Let’s explore how easy they are to use.Setup Process

Wave Accounting has a simple setup process. Users can sign up quickly. Basic business information is all that’s needed. QuickBooks offers a similar setup. The free version requires only basic details. The paid version provides guided setup. This is helpful for new users.Navigation

Wave Accounting’s dashboard is user-friendly. It displays key information clearly. Icons and menus are easy to understand. QuickBooks also has an intuitive interface. The free version offers fewer features. Paid versions have more tools but remain easy to navigate. Both platforms prioritize simplicity.Customer Support

Wave Accounting offers email support for all users. The free version may have slower response times. Paid users get priority support. QuickBooks provides phone and chat support. Free users have limited access. Paid users receive faster responses and more help. Both platforms offer helpful resources and guides. “`

Credit: www.waveapps.com

Integrations

Integrations play a crucial role in accounting software. They allow you to connect different tools, enhancing your workflow and productivity. Wave Accounting and QuickBooks both offer various integration options. Let’s delve into how each platform handles integrations.

Third-party Apps

Wave Accounting integrates with a limited number of third-party apps. These include payment processors like PayPal and Stripe. It also supports connections with e-commerce platforms.

QuickBooks, on the other hand, provides a vast library of third-party app integrations. You can link with tools for project management, CRM, and more. This extensive list makes QuickBooks highly adaptable to different business needs.

Bank Integration

Wave Accounting allows you to connect your bank accounts easily. It supports many major banks. This feature helps with automated transaction imports and categorization.

QuickBooks offers robust bank integration features too. It covers a wide range of financial institutions. You can automatically import transactions and reconcile accounts. This saves time and reduces manual entry errors.

Security Features

Security Features are crucial when choosing accounting software. Both Wave Accounting and QuickBooks offer free and paid options, but how do they compare? This section delves into the security features of each, helping you make an informed decision.

Data Protection

Data protection is a top priority for both Wave and QuickBooks. They use industry-standard encryption methods to secure your data.

| Feature | Wave Accounting | QuickBooks Free | QuickBooks Paid |

|---|---|---|---|

| Encryption | 256-bit SSL | 128-bit SSL | 256-bit SSL |

| Data Backup | Automatic Daily | Manual | Automatic Daily |

| Two-Factor Authentication | Available | Not Available | Available |

User Permissions

User permissions are essential for controlling access to sensitive data. Both platforms offer different levels of user permissions in their free and paid versions.

- Wave Accounting: Free users can assign basic roles. Paid users can set advanced permissions.

- QuickBooks Free: Limited to basic user roles. No advanced permissions.

- QuickBooks Paid: Offers detailed user permissions. You can control access to each feature.

QuickBooks paid options provide more control over user access. This can be crucial for larger teams.

Pros And Cons

Choosing the right accounting software can be a challenge. With many options available, understanding the pros and cons of each can help you make an informed decision. In this section, we’ll explore the advantages and disadvantages of Wave Accounting and QuickBooks, including their free and paid options.

Wave Pros And Cons

Wave Accounting is popular for its free features. But it also has some limitations. Here is a detailed look at the pros and cons of Wave.

| Pros | Cons |

|---|---|

|

|

Quickbooks Pros And Cons

QuickBooks offers both free and paid options. It is widely used by businesses of all sizes. Below are the pros and cons of QuickBooks.

| Pros | Cons |

|---|---|

|

|

Credit: www.saasant.com

Frequently Asked Questions

What Are The Main Differences Between Wave Accounting And Quickbooks?

Wave Accounting is free, while QuickBooks offers paid plans. Wave is simpler to use, whereas QuickBooks provides more advanced features. Both are great for small businesses, but QuickBooks offers better scalability.

Does Wave Accounting Have Any Hidden Costs?

Wave Accounting is free for basic accounting features. However, it charges for payroll and payment processing services. There are no hidden costs for its free features, making it a budget-friendly option.

Is Quickbooks Worth Paying For?

QuickBooks is worth paying for if you need advanced accounting features. It offers comprehensive tools for invoicing, payroll, and tax management. For growing businesses, QuickBooks is a valuable investment.

Can I Use Both Wave And Quickbooks Together?

Yes, you can use both Wave and QuickBooks together. Many businesses use Wave for basic accounting and QuickBooks for advanced features. This approach can help manage costs while leveraging the strengths of both platforms.

Conclusion

Choosing between Wave Accounting and QuickBooks depends on your needs. Wave offers solid free features for small businesses. QuickBooks provides more advanced tools with its paid plans. Both have strengths and weaknesses. Evaluate your business size and budget. Make an informed decision based on features and costs.

Happy accounting!