Square and QuickBooks are popular choices for payment processing. Both offer unique features and benefits.

Deciding between Square and QuickBooks can be challenging. Each platform provides essential tools for businesses to manage payments efficiently. Square is known for its user-friendly interface and ease of use. QuickBooks, on the other hand, excels in accounting integration and comprehensive financial management.

Understanding the strengths and weaknesses of each can help you choose the best option for your needs. This comparison will guide you through the key differences, making it easier to decide which platform aligns with your business goals. Stay tuned to find out which payment processing solution fits your requirements best.

Introduction To Payment Processing

Understanding payment processing is crucial for businesses. It’s the backbone of how transactions are handled and money flows into your account. Choosing the right payment processor can significantly impact your business’s efficiency and customer satisfaction.

Importance For Businesses

Payment processing affects your cash flow and operational efficiency. A reliable system ensures you get paid quickly and accurately.

Imagine a customer at your café. They tap their card, but the transaction fails. Frustration builds. The right payment processor minimizes these hiccups, ensuring seamless transactions that keep your customers happy and coming back.

Key Features To Consider

When evaluating payment processors like Square and QuickBooks, consider their features. Look at transaction fees, ease of use, and integration capabilities.

- Transaction Fees: Lower fees can save you money in the long run.

- Ease of Use: A user-friendly interface saves time and reduces errors.

- Integration: Seamless integration with your existing systems enhances efficiency.

For example, if you already use QuickBooks for accounting, using QuickBooks Payments could streamline your operations. On the other hand, Square’s point-of-sale system might be more intuitive for retail businesses.

Choosing between Square and QuickBooks isn’t just a technical decision; it’s a strategic one. What’s your priority – saving on fees, ease of use, or integration? Your choice should align with your business goals and operational needs.

Square Overview

Choosing the right payment processing system can be crucial for your business. Square and QuickBooks are two popular options, each with its unique features and advantages. In this section, we’ll dive into an overview of Square to help you understand what it offers and whether it might be the best fit for your needs.

History And Background

Square was founded in 2009 by Jack Dorsey and Jim McKelvey. It started with a simple idea: make credit card payments accessible for small businesses. They developed a small, square-shaped card reader that plugged into smartphones, allowing anyone to accept payments on the go.

Square has grown significantly since then. It’s now a major player in the payment processing industry, offering various tools and services beyond just card readers. Its user-friendly approach has attracted millions of businesses worldwide.

Have you ever wondered how a simple idea can transform an industry? Square’s journey shows that innovation can come from anywhere and change the way we do business.

Main Features

Square offers a wide range of features that can benefit your business. Here are some of the main ones:

- Point of Sale (POS) System: Square’s POS system is easy to set up and use. It helps you manage sales, inventory, and customer data all in one place.

- Card Readers: Their card readers are portable and allow you to accept payments anywhere. You can choose from contactless and chip readers, ensuring flexibility and security.

- Online Payments: Square makes it simple to accept online payments. Whether you have an e-commerce site or need to send invoices, Square has you covered.

- Reporting and Analytics: Square provides detailed reports and analytics to help you understand your sales trends and make informed decisions.

- Customer Engagement: With tools like loyalty programs and email marketing, Square helps you keep your customers coming back.

Imagine having all these features at your fingertips. Would it make managing your business easier? Square’s comprehensive suite of tools aims to streamline your operations and boost your efficiency.

As you consider your options for payment processing, think about what features matter most to you. Square’s history and main features make it a strong contender, especially for small businesses looking for simplicity and functionality.

Quickbooks Overview

QuickBooks is a popular tool for payment processing and accounting. It offers various features to help businesses manage their finances. Let’s dive into its history and main features.

History And Background

QuickBooks was launched by Intuit in 1983. It was designed to make accounting easier for small businesses. Over the years, it has grown and evolved. Today, QuickBooks is used by millions of businesses worldwide. Its success is due to its user-friendly design and comprehensive features.

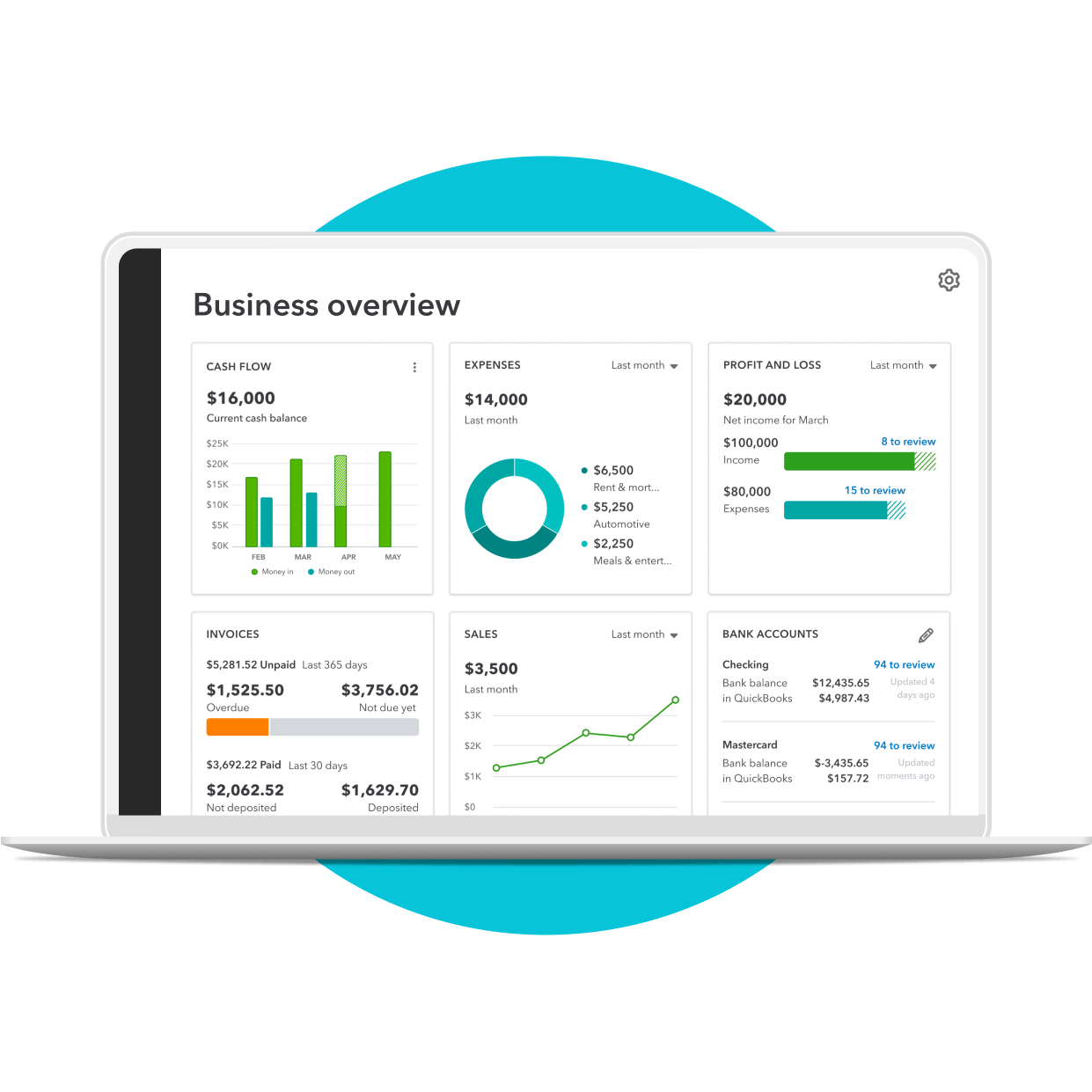

Main Features

QuickBooks offers a range of features. It helps with invoicing, expense tracking, and payroll management. You can also link your bank account to QuickBooks. This makes it easy to track your financial transactions.

Another feature is its reporting tools. These tools provide insights into your business’s financial health. QuickBooks also supports tax calculations. This helps you stay compliant with tax regulations.

QuickBooks integrates with other apps. This allows you to streamline your business operations. You can connect your payment processor, CRM, and other tools. This integration makes managing your business easier.

Customer support is another strong point. QuickBooks offers various support channels. You can reach out via phone, email, or chat. This ensures you get help when you need it.

Credit: cloudfriday.com

Comparing Costs

When deciding between Square and QuickBooks for payment processing, costs play a crucial role. Understanding transaction fees and subscription plans can save you a lot of money. Let’s break down these costs to help you make an informed choice.

Transaction Fees

Transaction fees can significantly impact your business, especially if you handle a large volume of transactions. Square charges a flat rate of 2.6% + 10¢ per swipe, dip, or tap for in-person transactions. This simplicity makes it easy to calculate what you’ll owe.

QuickBooks, on the other hand, offers a tiered fee structure. For in-person transactions, you’ll pay 2.4% + 25¢ per transaction. While QuickBooks’ rate may seem lower, the additional per-transaction fee can add up. Consider how many transactions you process monthly to see which option benefits you most.

Subscription Plans

Subscription plans can offer additional features but come with a cost. Square’s subscription plans start with a free tier, which includes basic payment processing. For more advanced features, such as payroll and marketing tools, you can upgrade to their premium plans, starting at $29 per month.

QuickBooks offers a range of plans, starting at $25 per month for their Simple Start plan. This plan includes invoicing and expense tracking, but you’ll need to pay more for advanced features like inventory management. Their most popular plan, Essentials, costs $50 per month, providing more comprehensive tools.

Both Square and QuickBooks offer trial periods, so you can test the waters before committing. Evaluate what features you need and compare the costs carefully. Is a more expensive plan worth the extra features? Or can you manage with a basic plan?

What are your priorities? Lower transaction fees or more comprehensive tools? Weigh these factors to see which aligns best with your business needs. The right choice can streamline your operations and save you money.

Ease Of Use

Choosing the right payment processing tool is essential for your business. Ease of use is a key factor. It affects how quickly you can start and how smooth your daily operations are. Let’s compare Square and QuickBooks on this front.

User Interface

Square boasts a clean and intuitive interface. It’s designed to be user-friendly. You can navigate through different sections effortlessly. The layout is straightforward, making it easy to find what you need.

QuickBooks also offers a user-friendly interface. It is more detailed due to its accounting features. The dashboard provides a comprehensive view of your financials. It may take some time to get used to the layout.

Setup Process

Setting up Square is quick and simple. You sign up, input your business details, and you are set. The process is streamlined, so even beginners can handle it.

QuickBooks requires more steps during setup. You need to configure various accounting options. This can be overwhelming at first. But the guided setup helps you through each step.

Credit: www.merchantmaverick.com

Customer Support

Customer support is a critical factor in choosing a payment processing service. Both Square and QuickBooks offer various support options. Let’s delve into the details of their customer support to see which one stands out.

Availability

Square provides customer support from 6 AM to 6 PM PT. Their support is available seven days a week. QuickBooks offers 24/7 customer support, ensuring help is available anytime.

Square has a comprehensive help center on their website. Users can find answers to common questions there. QuickBooks also provides a detailed help center and community forum for users to get assistance.

Quality Of Service

Square’s support team is known for their quick responses. They offer support via phone, email, and social media. Users often praise their friendly and helpful representatives.

QuickBooks also provides multiple support channels. Users can reach them via phone, chat, and email. Many users appreciate their knowledgeable support staff. They are trained to handle complex issues efficiently.

Both services have robust online resources. These include tutorials, FAQs, and user guides. These resources help users resolve issues on their own.

Integration Capabilities

When it comes to choosing between Square and QuickBooks for payment processing, one critical factor to consider is their integration capabilities. How well these platforms connect with other tools and software can greatly influence your business operations. Seamless integration can save you time, reduce errors, and streamline your workflow.

Third-party Apps

Square offers a diverse range of integrations with third-party apps. This includes everything from e-commerce platforms like Shopify to marketing tools like Mailchimp. These integrations can help you manage various aspects of your business, all from one central hub.

QuickBooks, on the other hand, also shines in this area. It integrates with over 650 popular business apps. Whether you need to sync with CRM tools like Salesforce or project management software like Trello, QuickBooks has you covered. This extensive network ensures that your financial data can easily flow between different systems.

Have you ever found yourself struggling to sync data between different apps? Both Square and QuickBooks aim to eliminate these headaches. By choosing a payment processor that integrates well with your existing tools, you can create a more efficient and connected business environment.

Accounting Software

One of the standout features of QuickBooks is its robust accounting software. As a product of Intuit, QuickBooks offers seamless integration with its own suite of financial tools. This means your payment data can be automatically categorized and reconciled, reducing the time you spend on bookkeeping.

Square also offers some integration with accounting software. It connects easily with QuickBooks, allowing you to import your sales data directly into your accounting system. Additionally, Square has partnerships with other accounting tools like Xero and Zoho Books, providing flexibility based on your preferences.

Think about the last time you had to manually enter sales data into your accounting software. By leveraging these integrations, you can automate much of this process. This not only saves time but also minimizes the risk of errors, helping you keep your financial records accurate and up-to-date.

Both Square and QuickBooks offer strong integration capabilities. Your choice may ultimately come down to which specific tools you already use and how you want to streamline your workflow. Which integrations matter most to you? Consider that as you decide between these two powerful payment processing options.

Security Features

When choosing between Square and QuickBooks for payment processing, security features are paramount. You need to ensure that your transactions are safe and your customers’ information is secure. Let’s break down the security features of both platforms under three key areas: data protection, fraud prevention, and user authentication.

Data Protection

Square ensures that all sensitive data is encrypted. This means that even if data is intercepted, it cannot be read or misused. Square also complies with PCI DSS (Payment Card Industry Data Security Standard), which is a set of requirements designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment.

QuickBooks also takes data protection seriously. It uses advanced, industry-recognized security safeguards to keep all your financial data private and protected. QuickBooks employs encryption technology to ensure that your data is secure during transmission and storage. The platform is designed to meet industry standards for data security.

Fraud Prevention

Both Square and QuickBooks have robust fraud prevention measures. Square uses machine learning to analyze transactions and detect potentially fraudulent activity. If a transaction appears suspicious, Square will hold it for further review. This way, you can avoid chargebacks and potential losses.

QuickBooks also employs a variety of tools to prevent fraud. It includes features like automatic transaction categorization and fraud detection alerts. These alerts notify you of unusual activity in real-time, allowing you to take immediate action. Additionally, QuickBooks offers user permissions, ensuring that only authorized individuals can access sensitive information.

Have you ever had an experience with fraud in your business? It can be a nightmare. Both Square and QuickBooks aim to minimize this risk, but it’s important to choose the one that fits your specific needs.

User Authentication

Security starts with who has access. Square offers two-factor authentication (2FA) to add an extra layer of protection. This means that even if someone gets hold of your password, they would also need your phone to access your account.

QuickBooks also supports two-factor authentication. This feature helps in preventing unauthorized access to your account. QuickBooks’ 2FA requires users to verify their identity using a secondary method, such as a text message or an authentication app.

Think about the last time you forgot a password. Imagine if that password protected your entire business. Strong user authentication features, like those offered by Square and QuickBooks, can prevent such scenarios from turning into disasters.

When it comes to security, both Square and QuickBooks offer robust features. The choice depends on your specific needs and how you prioritize different aspects of security. Which security feature is most important to you? The answer to that question might help you decide between Square and QuickBooks.

Pros And Cons

Deciding between Square and QuickBooks for payment processing can be challenging. Each has its own set of advantages and disadvantages. Understanding these can help you make an informed decision that best suits your business needs. Let’s dive into the pros and cons of each.

Square Advantages And Disadvantages

Square is known for its ease of use. It caters to small businesses and entrepreneurs. The platform offers a simple setup process. It also provides a free point-of-sale (POS) system.

One of the main advantages of Square is its transparent pricing. There are no hidden fees. You pay a flat rate per transaction. This makes budgeting easier. Another benefit is the hardware. Square offers various hardware options. These include card readers and terminals. They are affordable and easy to use.

On the downside, Square lacks advanced accounting features. It is limited in its integrations. This can be a drawback for growing businesses. Additionally, Square’s customer support has mixed reviews. Some users report slow response times.

Quickbooks Advantages And Disadvantages

QuickBooks is a robust accounting software. It is suitable for small to medium-sized businesses. The platform offers comprehensive accounting features. These include invoicing, payroll, and expense tracking.

One key advantage of QuickBooks is its integration with other software. It works well with many third-party applications. This can streamline your business operations. QuickBooks also offers detailed financial reports. These can help in decision-making.

However, QuickBooks can be complex to use. The setup process is more involved. It may require some training. Also, QuickBooks is more expensive than Square. The pricing structure can be confusing. There are various plans and add-ons. This can make budgeting difficult.

In summary, both Square and QuickBooks have their strengths and weaknesses. Your choice depends on your specific needs. Evaluate the pros and cons carefully. This will help you make the best decision for your business.

Credit: quickbooks.intuit.com

Final Verdict

Choosing between Square and QuickBooks for payment processing can be challenging. Both offer unique features that cater to different business needs. Let’s break it down to see which one suits your business best.

Best For Small Businesses

Square is often the go-to choice for small businesses. It is user-friendly and easy to set up. You don’t need to be a tech expert to get started.

I remember when I first started my online store. Square’s straightforward setup process saved me hours of time. Their transparent pricing model helped me avoid unexpected fees.

If you’re running a small business, you might appreciate Square’s intuitive dashboard. It allows you to manage sales, inventory, and customer data all in one place. Plus, the free mobile card reader is a bonus.

Square’s customer support is also commendable. They offer 24/7 service, which can be a lifesaver during busy times. Do you want a hassle-free payment processing solution? Square might be your best bet.

Best For Large Enterprises

On the other hand, QuickBooks shines for larger enterprises. It integrates seamlessly with its accounting software. This can streamline your financial management significantly.

A friend of mine runs a medium-sized company. He switched to QuickBooks and saw a noticeable improvement in his financial tracking. The detailed reports and analytics provided valuable insights into his business operations.

If you have a complex business structure, QuickBooks can handle it. It supports multiple users and offers advanced features like payroll management and inventory tracking.

QuickBooks also has robust security measures in place. This ensures that your sensitive financial data is protected. If your business requires a comprehensive financial solution, QuickBooks is likely the better choice.

Both Square and QuickBooks have their strengths. Your choice depends on your business size and specific needs. What features are most important to you? Think about your priorities and choose accordingly.

Frequently Asked Questions

Can Quickbooks Be Used As A Payment Processor?

Yes, QuickBooks can be used as a payment processor. It allows businesses to accept payments online, in-person, and via invoices.

What Percentage Does Quickbooks Take From Payment Processing?

QuickBooks charges 2. 4% to 3. 4% plus 25 cents per transaction for payment processing, depending on the payment method.

Is Quickbooks Being Phased Out?

QuickBooks is not being phased out. Intuit continues to support and update QuickBooks with new features and improvements.

Does Square Payments Integrate With Quickbooks?

Yes, Square payments integrate with QuickBooks. This allows seamless financial management and easy reconciliation of transactions.

Conclusion

Choosing between Square and QuickBooks depends on your business needs. Square offers simplicity and ease of use. QuickBooks excels in accounting integration. Both have unique strengths. Evaluate your requirements. Consider your budget and necessary features. Test both options if possible.

Make the choice that best fits your business. The right tool will streamline payments and boost efficiency.