Running a small business comes with many challenges. Managing finances shouldn’t be one of them.

Finding the best software for small business accounting can simplify your daily tasks. The right tool can help you track expenses, send invoices, and manage payroll with ease. As a business owner, you need reliable software that saves time and reduces errors.

This guide will introduce you to top accounting software options. Each choice offers unique features to fit different needs. Stay organized and focus more on growing your business, not just managing it. Let’s explore which software can make your accounting easier and more efficient.

Key Features To Look For

When choosing the best software for small business accounting, understanding the key features to look for can make a world of difference. The right tools can save you time, reduce errors, and help you make informed decisions. Here are the essential features you should consider:

Ease Of Use

Ease of use is crucial. You don’t want to spend hours learning how to navigate complex software. A user-friendly interface ensures that you and your team can quickly get up to speed.

Look for software that offers intuitive dashboards, clear instructions, and helpful tutorials. This way, you can focus more on growing your business rather than struggling with accounting tasks.

Have you ever abandoned software because it was too complicated? That’s exactly what you want to avoid here.

Integration Capabilities

Integration capabilities are another important feature. Your accounting software should seamlessly connect with other tools you use, like CRM systems, payroll services, and e-commerce platforms.

This integration ensures that data flows smoothly between different systems, reducing manual entry and the risk of errors. It can also provide a more comprehensive view of your business operations.

Imagine the ease of updating your sales numbers in real-time as transactions occur. Integration makes this possible.

Scalability

Scalability is often overlooked, but it’s vital for growing businesses. Your software should be able to grow with you, accommodating more users, transactions, and complex financial needs as your business expands.

Choose software that offers different plans or modules that you can add as needed. This flexibility ensures that you won’t outgrow your accounting tools too quickly.

Think about where you want your business to be in five years. Will your current software still meet your needs?

By focusing on these key features, you can find accounting software that not only meets your current needs but also supports your future growth. What features do you find most important in accounting software? Share your thoughts below!

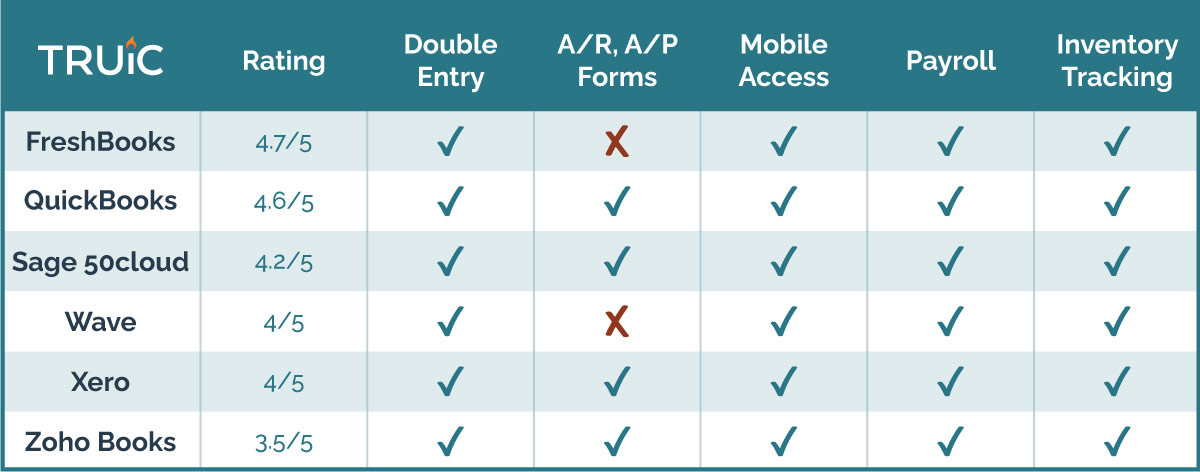

Quickbooks Online

Managing finances can be challenging for small businesses. QuickBooks Online simplifies this task. It’s a popular accounting software designed for small businesses. Users find it intuitive and efficient.

Features

QuickBooks Online offers many features to help manage your business finances. It supports invoicing, expense tracking, and payroll management. It integrates with many third-party apps, enhancing its capabilities. The software also provides detailed financial reports. These reports help business owners understand their financial health better.

Pricing

QuickBooks Online offers several pricing plans. The plans vary based on the features offered. The Simple Start plan is the most basic and affordable. It is suitable for solo entrepreneurs. The Essentials plan provides more features, including bill management. The Plus plan supports project tracking and inventory management. The Advanced plan is the most comprehensive, with premium features.

Pros And Cons

QuickBooks Online has many advantages. It is user-friendly and easy to navigate. The software offers robust features suitable for small businesses. It also provides excellent customer support.

There are a few drawbacks. The pricing may be high for some small businesses. Some users may find the learning curve steep initially. Despite these cons, QuickBooks Online remains a top choice for many.

Xero

Xero offers the best software for small business accounting. Manage invoices, payroll, and expenses effortlessly with this user-friendly tool. Simplify your financial tasks and focus on growth.

Are you a small business owner looking for a reliable accounting software? Xero might be the solution you need. Xero is popular among entrepreneurs due to its user-friendly interface and comprehensive features. Let’s explore why Xero is a great choice for small business accounting.Features

Xero offers a wide range of features designed to simplify your accounting tasks. You can track expenses, manage invoices, and reconcile bank transactions effortlessly. It also integrates with over 800 third-party apps, giving you flexibility to customize it according to your needs. With real-time financial reporting, you can stay on top of your business’s financial health and make informed decisions.Pricing

Xero offers different pricing plans to fit various business sizes and needs. The Starter plan is perfect for small businesses with basic needs and costs $20 per month. The Standard plan, at $30 per month, offers additional features like bulk reconciliation and includes payroll processing. If your business has more complex requirements, the Premium plan at $40 per month might be the best fit, with advanced multi-currency support.Pros And Cons

- Pros:

- Easy to use interface, even for non-accountants.

- Highly customizable with numerous integrations.

- Real-time updates keep your data current.

- Excellent customer support and resources.

- Cons:

- Can be expensive for very small businesses.

- Some users report occasional syncing issues with bank accounts.

- Mobile app lacks some desktop features.

Freshbooks

FreshBooks offers an easy solution for small business accounting. It simplifies invoicing, expense tracking, and financial reporting. Ideal for entrepreneurs and freelancers.

If you’re a small business owner looking for an easy-to-use accounting software, FreshBooks might be the perfect solution for you. FreshBooks is known for its user-friendly interface and robust features designed to make accounting less daunting. Whether you’re a freelancer, consultant, or running a small company, FreshBooks can help you manage your finances efficiently.Features

FreshBooks offers a range of features that cater to the needs of small businesses. Invoicing: You can create professional-looking invoices in just a few clicks. Customizable templates allow you to add your logo and branding. Expense Tracking: Easily track your expenses and categorize them for better financial management. You can even snap pictures of receipts and upload them directly. Time Tracking: If you bill clients by the hour, FreshBooks’ time tracking feature is invaluable. It helps you log hours worked and ensures you get paid accurately. Reports: FreshBooks provides insightful financial reports. These reports help you understand your business performance and make informed decisions. Integration: FreshBooks integrates with various apps, including payment gateways like Stripe and PayPal, making transactions seamless.Pricing

FreshBooks offers several pricing plans to suit different business needs. Lite Plan: Priced at $15/month, it’s suitable for freelancers and solo entrepreneurs. It supports up to 5 billable clients. Plus Plan: At $25/month, this plan is ideal for small businesses with up to 50 billable clients. It includes additional features like double-entry accounting reports. Premium Plan: For $50/month, this plan supports unlimited billable clients and offers advanced features suitable for growing businesses. FreshBooks also offers a 30-day free trial, allowing you to test the software before committing.Pros And Cons

Pros: – User-Friendly: The intuitive interface makes it easy even for non-accountants to use. – Mobile Access: Manage your finances on the go with FreshBooks’ mobile app. – Customer Support: FreshBooks offers excellent customer service, including phone support. Cons: – Limited Customization: While FreshBooks offers several templates, customization options are somewhat limited. – Cost: The pricing can be a bit steep for very small businesses or startups. – Advanced Features: Some advanced features available in other accounting software are missing. FreshBooks makes accounting accessible and stress-free. Have you tried it yet? What features do you find most useful? Share your thoughts in the comments below!Wave Accounting

Wave Accounting is an excellent choice for small business owners. It offers free, easy-to-use tools for managing finances. Track expenses, send invoices, and more with this software.

Wave Accounting is a popular choice for small businesses. It offers an array of user-friendly features. Wave Accounting stands out due to its cost-effectiveness and ease of use. This software helps small business owners manage their finances effortlessly.Features

Wave Accounting provides a range of features. It includes invoicing, expense tracking, and receipt scanning. Users can connect their bank accounts for easy transaction tracking. The software generates financial reports. It also offers payroll services, which are handy for businesses with employees. The dashboard is intuitive and easy to navigate.Pricing

Wave Accounting is free for the core features. This includes invoicing, accounting, and receipt scanning. There are optional paid services. For example, payroll starts at $20 per month. Payment processing fees apply when accepting payments through Wave. These fees are competitive with industry standards.Pros And Cons

Credit: www.pcmag.com

Zoho Books

Zoho Books is an accounting software designed for small businesses. It helps manage finances, track expenses, and generate reports. Its user-friendly interface makes it easy for non-accountants to use. Zoho Books integrates well with other Zoho apps, offering a complete business solution.

Features

Zoho Books offers various features to streamline your accounting needs. It includes invoicing, expense tracking, and bank reconciliation. You can also manage projects, track inventory, and handle tax compliance. The software supports multiple currencies and integrates with payment gateways. Automated workflows save time by reducing manual tasks. Zoho Books also provides real-time reports for better financial insights.

Pricing

Zoho Books offers different pricing plans to suit various business needs. The free plan is available for businesses with revenue under a certain limit. Paid plans start at $9 per month. Higher-tier plans offer advanced features like project management and inventory tracking. You can also opt for a 14-day free trial to test the software. Discounts are available for yearly subscriptions.

Pros And Cons

Pros:

- User-friendly interface

- Comprehensive feature set

- Integration with other Zoho apps

- Affordable pricing

- Real-time financial reports

Cons:

- Limited customization options

- Customer support can be slow

- Some features only available in higher plans

Sage Business Cloud Accounting

If you’re a small business owner looking for reliable accounting software, Sage Business Cloud Accounting is worth considering. This software is designed to simplify your financial management tasks. It helps you stay on top of your business finances with ease and efficiency.

Features

Sage Business Cloud Accounting offers a range of features to cater to your accounting needs. It supports invoicing, expense tracking, and bank reconciliation. The dashboard provides a real-time overview of your cash flow and financial health.

You can manage your taxes effortlessly with automated calculations. The software also integrates with your bank, making it easier to track transactions. Plus, it offers mobile access, so you can manage your finances on the go.

Pricing

Pricing for Sage Business Cloud Accounting is designed to be affordable for small businesses. It offers different plans based on the features you need. The basic plan starts at a low monthly fee, which includes essential accounting features.

There are higher-tier plans that offer additional features like advanced reporting and multi-currency support. You can choose the plan that fits your business needs and budget. They also offer a free trial, so you can test the software before committing.

Pros And Cons

Like any software, Sage Business Cloud Accounting has its pros and cons. Here are some to consider:

| Pros | Cons |

|---|---|

|

|

Choosing accounting software is a big decision for your business. Sage Business Cloud Accounting might be the right fit if you need a user-friendly, cost-effective solution.

Have you tried Sage Business Cloud Accounting? What was your experience? Share your thoughts in the comments below!

Kashoo

Kashoo is the best software for small business accounting. It simplifies bookkeeping tasks with easy-to-use features and real-time updates. Small businesses can manage finances efficiently with Kashoo.

When it comes to managing your small business finances, Kashoo is an accounting software that stands out. It’s designed specifically for small business owners who need a simple yet powerful tool to handle their accounting needs. With its user-friendly interface and robust features, Kashoo can save you a lot of time and headaches.Features

Kashoo offers a range of features that are perfect for small business accounting. It allows you to track income and expenses, manage invoices, and run reports with ease. You can connect your bank accounts to automatically import transactions. Another great feature is the real-time dashboard. It gives you a quick snapshot of your financial health, so you always know where you stand. Kashoo also supports multiple currencies, making it ideal if you do business internationally. One of my favorite features is the ability to snap and store receipts. This makes expense tracking a breeze. You no longer need to keep a box of paper receipts; just snap a photo and upload it.Pricing

Kashoo offers straightforward pricing plans. There is a free trial available so you can test the waters before committing. The monthly plan costs $19.95, while the annual plan is $199.95, saving you a bit of cash if you pay upfront. They also offer a premium plan at $29.95 per month, which includes advanced features like project tracking and more detailed reports. This can be especially useful if your business has more complex accounting needs.Pros And Cons

- Pros:

- Easy to use, even for those without accounting experience

- Real-time dashboard for instant financial insights

- Affordable pricing with options for different needs

- Excellent customer support

- Cons:

- Limited customization options for invoices

- Fewer integrations compared to some competitors

- Mobile app could be more robust

Oneup

Choosing the right accounting software for your small business can be challenging. OneUp offers a great solution that is both user-friendly and feature-rich. This software is perfect for small businesses that need to manage their finances efficiently.

Features

OneUp comes with a variety of features that make accounting easier. It offers automated bookkeeping, which saves you time by recording transactions automatically. You can also manage invoices, track expenses, and handle inventory in one place.

Another great feature is its integration with your bank. This allows you to sync your bank transactions directly, ensuring your financial data is always up-to-date. OneUp also provides real-time insights, helping you make informed business decisions.

Pricing

OneUp offers multiple pricing plans to suit different business needs. The starter plan is affordable and includes basic features. For more advanced features, you can opt for higher-tier plans. Each plan is priced competitively, ensuring you get good value for your money.

Pros And Cons

OneUp has many advantages. It is easy to use, making it ideal for those who are not tech-savvy. The integration with banks and automated bookkeeping are big time-savers. The software also scales well, growing with your business.

On the downside, OneUp might lack some advanced features that larger businesses need. Also, the customer support can sometimes be slow to respond. Despite these minor drawbacks, OneUp remains a solid choice for small business accounting.

Kashflow

If you’re a small business owner looking for a reliable accounting software, KashFlow could be a game-changer. It’s designed to simplify your bookkeeping tasks and help you manage your finances effortlessly.

Features

KashFlow offers a variety of features tailored for small businesses. You can easily track your income and expenses, generate invoices, and even manage VAT.

One standout feature is the automatic bank feeds, which sync your transactions directly from your bank. This saves you time and minimizes errors.

KashFlow also includes payroll functionality, allowing you to manage employee salaries and deductions seamlessly. Plus, it integrates with several payment processors like PayPal and Stripe.

Pricing

Pricing for KashFlow is straightforward. They offer three different plans: Starter, Business, and Business + Payroll.

The Starter plan is perfect for freelancers or small businesses just getting started. It costs around £8 per month.

The Business plan, at £16 per month, includes additional features like quotes and estimates. For larger businesses that need payroll services, the Business + Payroll plan is £22 per month.

Pros And Cons

Pros:

- Easy to use interface

- Automatic bank feeds

- Comprehensive payroll features

Cons:

- Limited customization options

- Customer support can be slow

- Some advanced features are only available in higher-tier plans

Using KashFlow has made my business accounting a breeze. I no longer dread end-of-month reconciliations. Have you considered how much time you could save with automated bank feeds?

Take a closer look at KashFlow and see if it’s the right fit for your business. Your financials deserve the best management tools available.

Sunrise

Sunrise is a powerful tool for small business accounting. Its user-friendly interface and robust features make it an ideal choice. Sunrise helps manage finances efficiently and effortlessly.

Features

Sunrise offers a range of features for small businesses. It includes automated invoicing and expense tracking. Users can generate financial reports easily. The software also provides multi-currency support. Integration with various bank accounts is seamless. Sunrise also offers a mobile app for on-the-go access.

Pricing

Sunrise provides a free version for small businesses. The free version includes basic features. For advanced features, Sunrise offers paid plans. The plans are affordable and cater to different business needs. Pricing starts at $19 per month. Users can choose the plan that best suits their requirements.

Pros And Cons

Sunrise has several advantages. It is easy to use and has a clean interface. The free version is very useful for small businesses. Automated invoicing saves time. Multi-currency support is beneficial for global transactions.

There are some cons as well. The free version has limited features. Advanced features require a paid plan. Customer support is not available 24/7. Some users may find the integration options limited.

Credit: howtostartanllc.com

Credit: online.jwu.edu

Frequently Asked Questions

What’s The Easiest Accounting Software To Use?

QuickBooks is widely regarded as the easiest accounting software to use. Its user-friendly interface simplifies financial management.

How Much Do Quickbooks Cost For A Small Business?

QuickBooks costs for small businesses start at $25 per month for Simple Start. Pricing varies based on plan features.

Is Quicken Or Quickbooks Better For Small Business?

QuickBooks is better for small businesses due to its advanced features, scalability, and support for multiple users. Quicken is best for personal finance.

Which Is The Best Accounting Software For Small Business For Free?

Wave is the best free accounting software for small businesses. It offers invoicing, expense tracking, and receipt scanning.

Conclusion

Choosing the right accounting software is vital for small businesses. It simplifies financial tasks. Helps track expenses. Ensures accurate reporting. Saves time and reduces errors. Popular options include QuickBooks, Xero, and FreshBooks. These tools offer user-friendly interfaces. And great customer support.

Evaluate your needs. Pick the software that fits. Boost your business efficiency. Stay organized. Make informed decisions. Keep your finances in check. The right software helps your business grow. Select wisely. Enjoy smoother financial management.